How to Choose the Most Reputable Secured Credit Card Singapore for Your Requirements

How to Choose the Most Reputable Secured Credit Card Singapore for Your Requirements

Blog Article

Unveiling the Possibility: Can People Discharged From Personal Bankruptcy Acquire Credit Rating Cards?

Comprehending the Impact of Bankruptcy

Upon declare insolvency, individuals are faced with the significant effects that permeate different facets of their economic lives. Personal bankruptcy can have an extensive effect on one's credit rating, making it testing to gain access to credit or fundings in the future. This monetary discolor can remain on credit reports for numerous years, affecting the individual's capacity to safeguard favorable rates of interest or financial chances. Furthermore, insolvency may result in the loss of properties, as particular belongings may need to be liquidated to repay lenders. The psychological toll of bankruptcy should not be ignored, as individuals might experience feelings of shame, sense of guilt, and anxiety because of their economic situation.

Furthermore, personal bankruptcy can limit employment possibility, as some employers perform credit rating checks as part of the hiring procedure. This can pose an obstacle to people seeking new task prospects or occupation advancements. On the whole, the effect of personal bankruptcy extends beyond monetary restrictions, affecting numerous aspects of a person's life.

Variables Influencing Credit Scores Card Approval

Adhering to insolvency, people commonly have a reduced credit rating score due to the adverse influence of the personal bankruptcy declaring. Credit rating card companies normally look for a credit score that demonstrates the applicant's ability to handle credit responsibly. By meticulously taking into consideration these aspects and taking steps to rebuild credit history post-bankruptcy, individuals can improve their potential customers of acquiring a credit history card and functioning towards financial healing.

Steps to Rebuild Credit Report After Insolvency

Reconstructing credit score after personal bankruptcy needs a strategic approach concentrated on economic self-control and consistent debt monitoring. The initial step is to evaluate your credit history report to ensure all financial debts included in the bankruptcy are accurately mirrored. It is important to develop a budget plan that prioritizes debt repayment and living within your ways. One reliable technique is to obtain a protected bank card, where you transfer a particular amount as security to develop a credit rating limitation. Prompt payments on this card can show responsible credit scores use to possible lenders. Furthermore, think about coming to be an accredited user on a family members participant's charge card or discovering credit-builder lendings to additional increase your credit history. It is crucial to make all repayments on time, as repayment background dramatically impacts your credit report. Patience and determination are key as reconstructing credit report takes time, however with dedication to seem economic techniques, it is feasible to improve your creditworthiness post-bankruptcy.

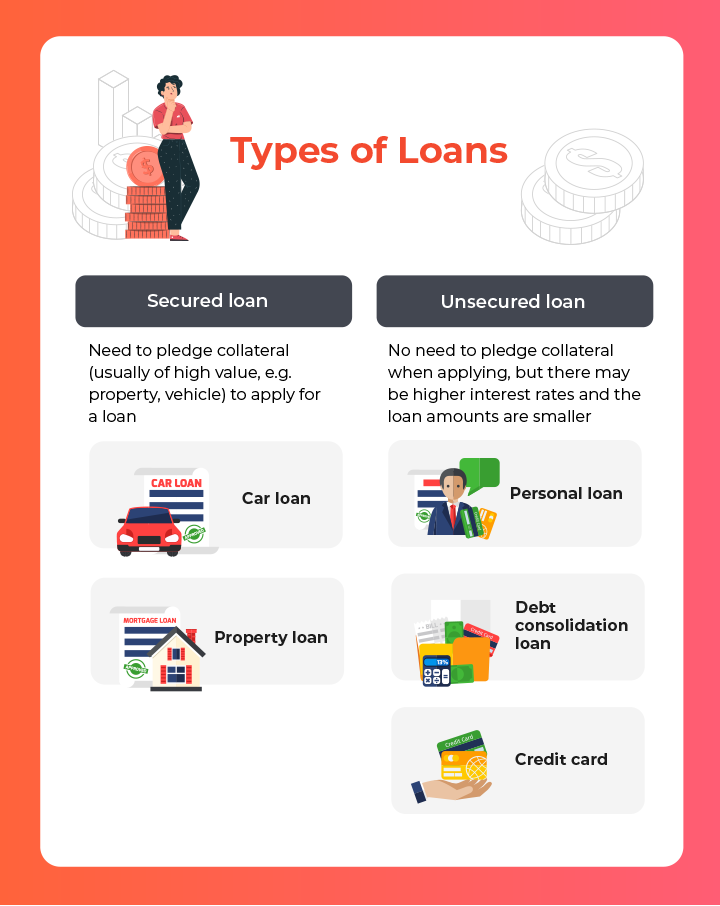

Secured Vs. Unsecured Debt Cards

Adhering to insolvency, people often take into consideration the selection between safeguarded and unprotected credit report cards as they aim to rebuild their creditworthiness and monetary stability. Guaranteed credit cards call for discover here a cash down payment that offers as security, normally equal to the credit rating restriction approved. Ultimately, the option in between protected and unsafe credit rating cards need to straighten with the individual's financial purposes and capability to manage credit rating sensibly.

Resources for Individuals Looking For Credit Restoring

For individuals intending to boost their credit reliability post-bankruptcy, discovering readily available resources is essential to effectively navigating the debt restoring procedure. secured credit card singapore. One valuable source for individuals looking for credit history restoring is credit report therapy agencies. These companies use financial education, budgeting support, and customized debt improvement plans. By collaborating with a credit rating counselor, people can obtain insights into their credit score reports, find out methods to improve their credit history, and get support on handling their funds successfully.

An additional useful source is credit report monitoring solutions. These solutions allow individuals to maintain a close eye on their debt records, track any type of inaccuracies or adjustments, and find prospective indications of identity theft. By checking their credit rating routinely, people can proactively deal with any kind of problems that might emerge and make sure that their credit score information is up to day and accurate.

Furthermore, online devices and sources such as credit rating simulators, budgeting apps, and monetary proficiency sites can give people with valuable info and try this devices to aid them in their credit rating reconstructing trip. secured credit card singapore. By leveraging these resources successfully, people discharged from insolvency can take purposeful steps towards boosting their credit report wellness and securing a better monetary future

Verdict

In conclusion, people released from bankruptcy might have the possibility to get bank card by taking actions to rebuild their credit history. Variables such as credit scores earnings, background, and debt-to-income ratio play a considerable function in credit history card approval. By comprehending the effect of personal bankruptcy, choosing in between safeguarded and unprotected bank card, and making use of sources for credit restoring, people can enhance their credit reliability and potentially get access to read more charge card.

By working with a credit scores counselor, people can obtain insights into their debt records, learn techniques to boost their credit report scores, and obtain assistance on managing their funds efficiently. - secured credit card singapore

Report this page